A digital asset

investment fund

Viska is an alternative investment fund based in Iceland that invests in digital assets.

Viska is an alternative investment fund based in Iceland that invests in digital assets.

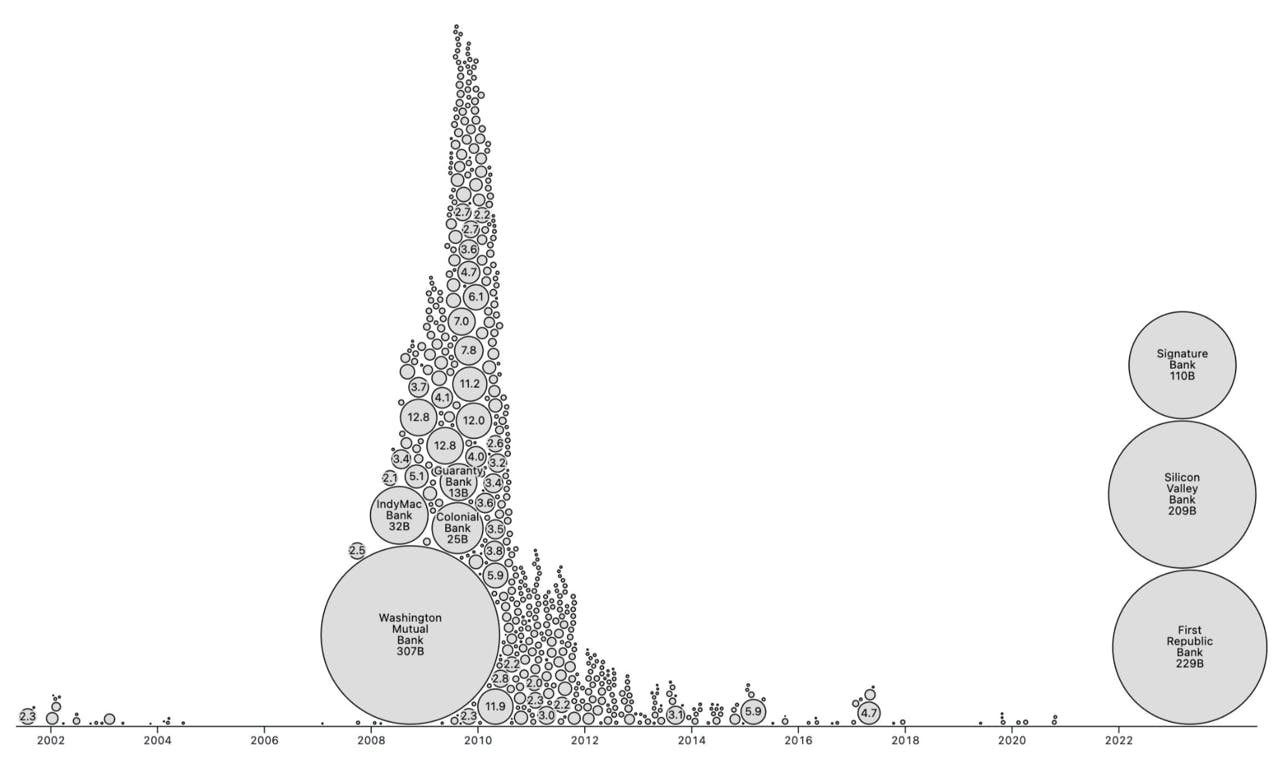

The banking crisis in the United States is in full swing, with three major American banks being taken over or declared bankrupt. These three banks are among the largest that have collapsed in the history of the United States. Yesterday, on May 3, a notification came from Pacific Western Bank (PacWest), which announced that they were seeking ways to save the bank from failure as its value has dropped about 90% over the past month. In the era of online banking and smartphones, depositors react faster to concerns about banks' status, and funds have flowed into safer assets. Here we see an image showing the fallen banks in the United States and their size compared to banks that fell after the great financial crisis of 2008.

Figure 1 – Banks that have collapsed in the United States in the last 21 years by size (Source: Mike Bostock)

The international bank Standard Chartered published an article in April discussing how Bitcoin has gained increased attention in the current banking crisis. The head of the digital currency analysis department at Standard Chartered, Geoff Kendrick, discusses in the aforementioned article how Bitcoin could reach prices of up to $100,000 by the end of 2024. However, it is worth noting that high-flown predictions about Bitcoin's value have not always been realized, as it is challenging to predict short-term price development. But it is interesting to note that these considerations come from a major international bank.

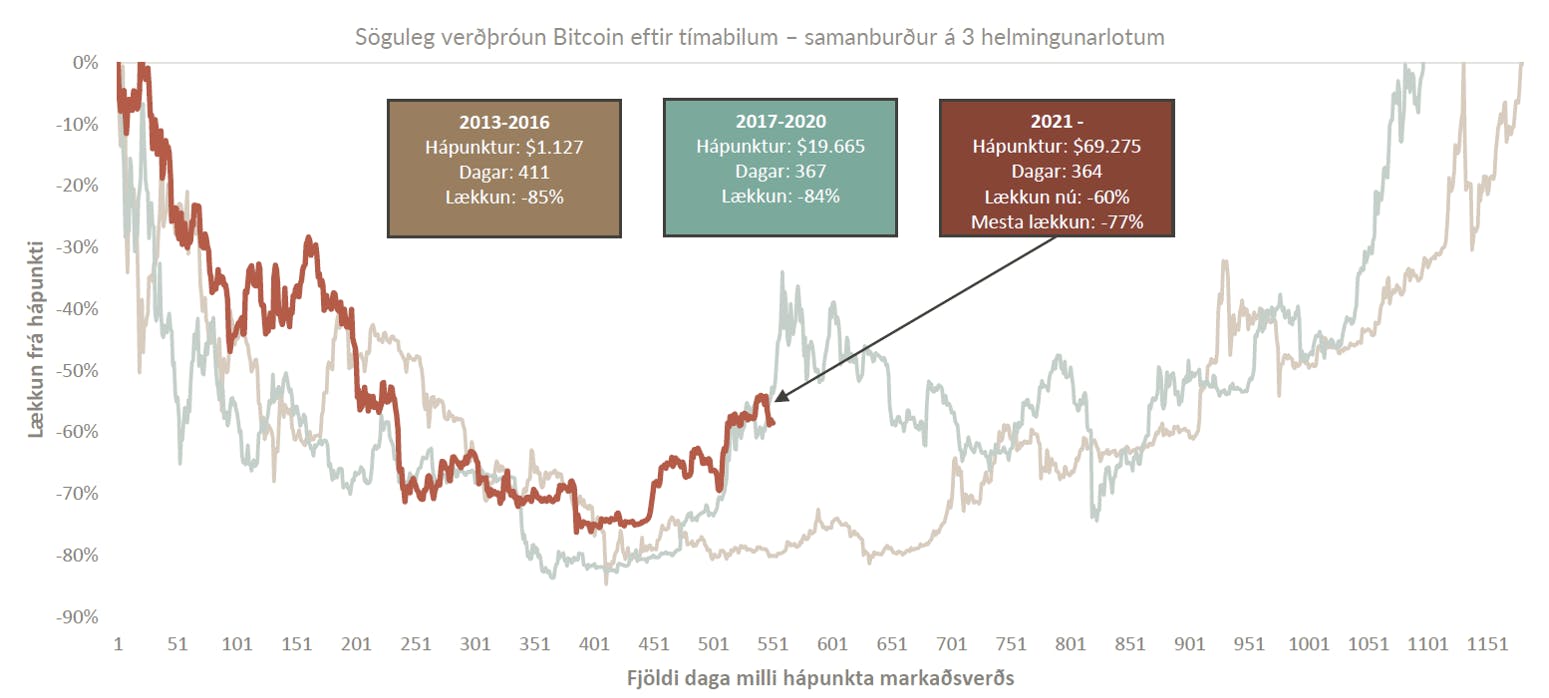

On the other hand, the price development of Bitcoin generally follows fairly consistent 4-year periods, which occur around so-called halving cycles when the number of Bitcoins produced daily decreases by half. The next halving will occur in spring 2024 or about one year. In this image, the current period from 2021 is compared with the last two halving cycles. The starting point of each cycle in the picture marks the peak of that cycle. When the price of Bitcoin has dropped for about 400 days from the last peak, it usually begins to recover and aim toward the high again.

Figure 2 - Historical price development of Bitcoin by periods - comparison of the last three halving cycles

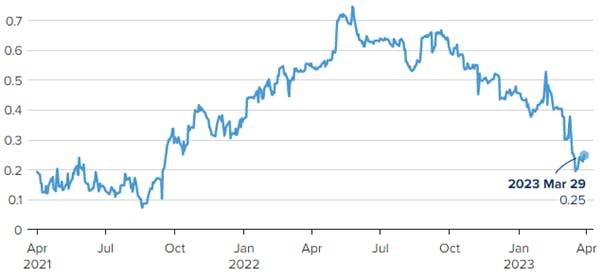

It is also interesting to note that Bitcoin's correlation with the S&P500 index has significantly decreased and has not been lower in 1.5 years. In March, we saw Bitcoin make significant increases at the same time as banks fell in value.

Figure 3 - Correlation between Bitcoin and the S&P500 stock index (CNBC, March 2023)

Therefore, the current banking crisis in the United States is not over, and it is unclear how it will play out. More likely, the authorities will need further interventions to resist the continued onslaught on smaller banks in the United States. History tells us that such interventions have positively affected the price development of independent assets with limited supply, such as Bitcoin and gold. Therefore, it will be interesting to monitor developments in the coming months.

Sources: