A digital asset

investment fund

Viska is an alternative investment fund based in Iceland that invests in digital assets.

Viska is an alternative investment fund based in Iceland that invests in digital assets.

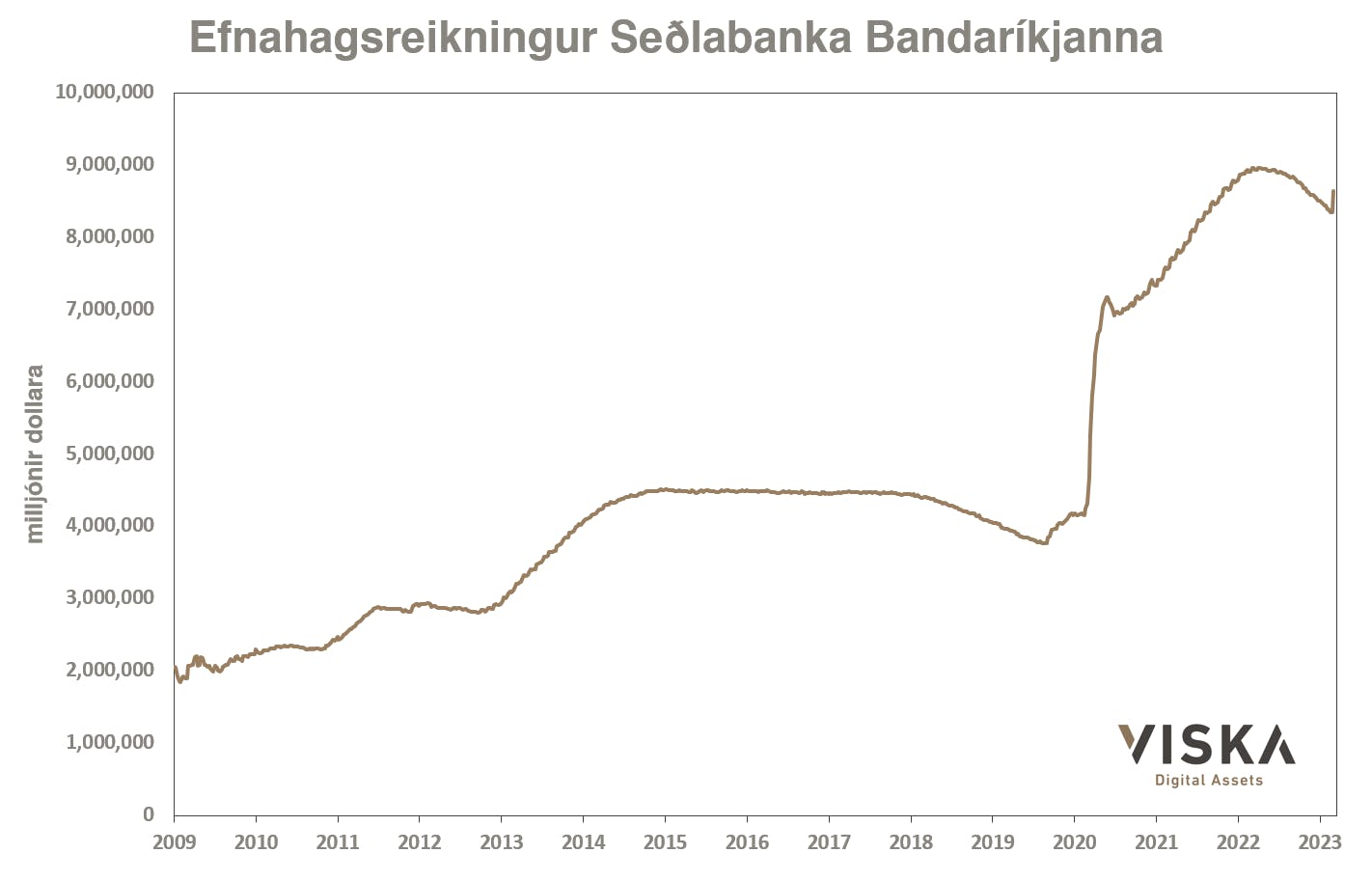

Updated figures on the Federal Reserve's (FED) economic account status were published yesterday. It's safe to say that a significant policy shift of the bank can be noted when examining the figures.

Before going further, it's worth pointing out that we wrote extensively about this development in early September last year for investors in Viska. The report details the evolution of the FED's economic account from 2009. You can read the article here, which states the following, among other things:

"One of the biggest influencers in financial markets is liquidity. The cryptocurrency market is no exception. Central banks have a tremendous impact on liquidity in the system and use methods such as quantitative easing (QE) when increasing liquidity and quantitative tightening (QT) when reducing liquidity. Central banks increase liquidity in the system by purchasing securities in the market, usually bonds, and reduce liquidity by selling securities."

Source: https://fred.stlouisfed.org/series/WALCL

The FED's balance sheet peaked in April last year, standing at just under 9 trillion USD. Since then, the FED has been working to reduce its economic account to tighten financial conditions. The decline from April 2022 to March 8, 2023, was about 600 billion USD, which is significant but only about a 7% reduction in the bank's balance sheet.

The latest figures published yesterday were interesting as the FED's balance sheet increased by 300 billion USD in a week! In other words, the money printing is back in full swing.

In this context, it's interesting to recall the words of Ben Bernanke from 2010 (Fed Chairman from 2006-2014):

"I think we would like to bring the balance sheet back to where it was before the crisis, [...], something under a trillion dollars."

It's safe to say that these words have aged poorly. The economic account has multiplied since then and currently stands at just over 8.6 trillion USD.

The Viska team has delved deep into these issues in recent months, and it's worth pointing to Guðlaugur's article called "World Central Banks in a Tight Dance," published in the leading Icelandic business paper Viðskiptablaðið in October 2022. You can read the article here. These words from the article are very relevant now:

"The history has many examples of unsustainable national debt situations where money printing has been used to finance wars and budget deficits. Most of these precedents are such that unsustainable debt situations are corrected with prolonged periods of inflation with the corresponding erosion of the purchasing power of the inhabitants of the respective countries."

The incentives in the system are such that money printing is the chosen path when things go awry. Currently, the foundations of the banking system in the United States are shaking, and the FED has intervened to save matters, thereby restarting the money printing machines. History tells us that this development is just going to continue.

What is the value of money that can be printed in endless amounts without any constraints?